Have a Happy Christmas on a Budget – 12 Ways to Save Money at Christmas

This website may earn commissions from purchases made through links in this post.

Christmas can be a time of big spending. But it doesn’t have to be. You can have a wonderful Christmas on a budget. Here’s how.

The presents are all unwrapped, the Christmas ham is eaten, and you’ve scoured the sales bins for that had-to-have bargain.

Then the credit card statement comes.

And the post-Christmas debt pain begins.

According to the RBA, Australians borrowed nearly $30 million on credit cards in December 2018. The average Aussie who uses the credit card to pay for Christmas can take from 3 to 6 months to pay it off.

That’s months of playing catch up. Months of not saving for the family holiday or having money to pay for the bills or meeting daily expenses.

Ideally, if you’re going to splurge at Christmas, it’s a good idea to start a Christmas fund at the beginning of the year, so you can save up bit by bit and pay cash at Christmas without any stress or worry.

But if you’ve waited until November or later to think about Christmas, there are other options for avoiding the Christmas debt hangover.

12 Ways to save at Christmas and avoid debt

Below are some ideas for saving at Christmas, so you can have a wonderful Christmas without going into debt.

1. Plan and budget

Save at Christmas by planning now. Write a list of recipients you are giving gifts to and gift ideas for each [see How to be a gift-giving guru for ideas].

Write down a set amount you want to spend on each person and add up the total. Then add things like wrapping and food and that’s your Christmas budget.

What if it’s more than you have to spend? You may need to massage your gift list, look for bargains or get creative to stay within your budget.

One great way to budget for gifts is to ask your recipients what they want. You may be surprised. My brother has asked for socks and jocks three years running. He’d rather save on necessities by getting them as gifts, so he can spend his own money on stuff he really wants.

2. Rationalise your gift-giving

I know this sounds harsh, but once you’ve written a list of recipients, start crossing people off. Do you really need to buy a gift for Joe in accounts?

Gift-giving should be meaningful, not done because it’s expected. Giving rubbishy gifts to people who don’t really want it and just end up throwing it out anyway doesn’t serve anyone. Give with meaning, not because you feel you have to.

3. Buy in bulk

Having said that, if you want to get gifts for teachers and work colleagues, consider buying items in bulk and save time and money. But think of gifts that will actually get used – practical gifts like food gifts that won’t just end up in landfill.

4. Make your own

Making your own gifts can be a great way to save money. Spending a day baking can result in bulk gifts for teachers and work colleagues. Check out the handmade gift series for ideas.

5. Give time

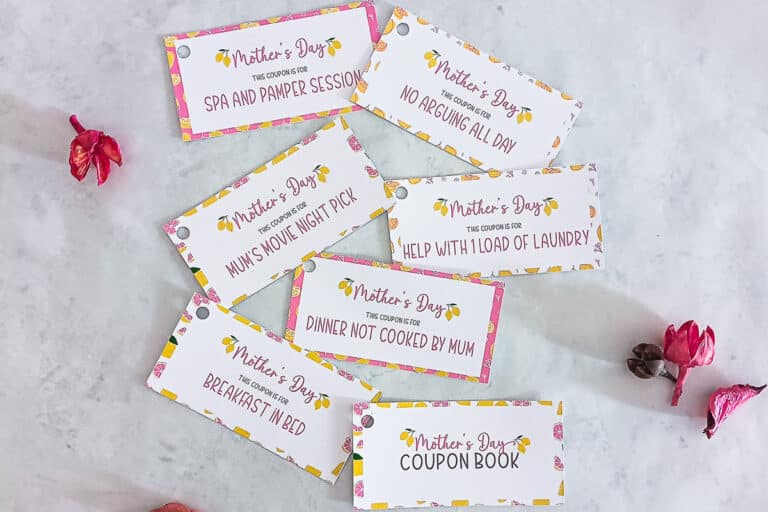

For the person who has everything, the gift of your time or your skills could be well received. So that the recipient receives something on the day, you could give personalised gift certificates for the time or service that you’re offering.

6. Cut back on other expenses and save

Every coffee, paper, work lunch and takeaway that you don’t buy will give you some extra cash for Christmas. Every time you say no and save a few dollars, put them aside for Christmas.

Have a no-spend week or month and cut your spending back to the bone so you can save up and pay for Christmas with cash.

Further reading: 10 Ways to Save Money Right Now and 6 Ways to Find Quick Cash.

7. Look for Bargains

It seems that stores are permanently on sale these days. Even before Christmas, there are plenty of sales and bargains to be had. And with online stores, there’s no need to pay full retail price ever again.

Signing up to store emails can be advantageous at this time of the year, so you can be notified of specials. Unsubscribe after Christmas to avoid the temptation to buy the stuff you don’t need.

8. Kris Kringle it

Many families opt to buy presents for kids only. If this isn’t an option, you could suggest a Kris Kringle or Secret Santa, where names are drawn out of a hat, and you buy a gift for just that person.

This way you only have to buy one gift, yet nobody misses out.

9. Share the cost of feeding the family

If you’re having a big family gathering, then getting everyone to bring a dish, drinks or nibbles will help spread the costs so the burden doesn’t rest entirely on your shoulders.

This is especially easy if you spend a typically Australian Christmas having a BBQ or picnic on the beach but even parts of a traditional Christmas roast can be shared amongst the family.

10. Be choosy about Christmas parties

If you have a full social calendar around the holidays, you might consider going to those Christmas parties you really want to and avoid attending the ones you don’t want to attend.

The costs around Christmas time don’t just include gift buying. All the social events around this time of year can add up as well.

11. Don’t buy for yourself

Do you find with all that present shopping that you get just a little bit tempted to throw in a few gifts to self?

I know I do.

Instead, write those ideas down. If you find you really want that special thing after a couple of days, tell those who are buying for you.

That way, you get what you really want at Christmas, you take the pressure off loved-ones to think of the perfect gift, and you save money, helping you to avoid Christmas debt.

12. Emphasise the True Meaning of Christmas

At the end of the day, Christmas isn’t about how much money we spend. If we take the emphasis off consumer goods and make presents only one aspect of the day, then the pressure is off buying lots of expensive gifts.

What you choose to emphasise at Christmas time is up to your family. Start a family tradition, if you don’t have one already.

For our kids, they really just want to spend quality time together as a family. Sure, they like getting gifts, but when we ask what they want for Christmas, they always ask to go to the park together or picnic on the beach.

So consider investing in memories, not stuff.

It can be hard balancing expectations with your values (and your budget) at Christmas time – the tension between generosity and frugality and an underlying suspicion that we’re all just buying ‘stuff’ out of obligation.

But at the end of the day, going into debt for more stuff that we don’t need is a symptom of a consumer culture that isn’t healthy for anyone. Emphasise a different Christmas tradition, one where the gifts are just a part of the day, not the focus.