When to Track Expenses and When Not To – The First Step to Budgeting

This website may earn commissions from purchases made through links in this post.

Some budgeting gurus suggest you should always track expenses. But life is too short. This article covers when it’s a good idea to track expenses and times when it isn’t necessary.

I’m not a fan of long-term expense tracking.

It’s time-consuming and it’s backwards budgeting.

But…

There are times when it’s useful to track expenses, so it’s important to know when to do it.

The picture above isn’t just pretty; it’s a metaphor: tracking your expenses involves following the trail of money that you’ve already spent.

An effective budget is one that helps you be proactive with your money, not reactive; tracking your expenses and then thinking ‘Oops, we overspent‘ doesn’t help you achieve your financial goals.

It’s one of the reasons why many budgets fail.

So, what’s the purpose of tracking your expenses?

It’s to understand your current spending patterns and habits. Because saving money isn’t about spreadsheets or financial apps but everyday habits.

They say that knowledge is power. Knowing what you spend your money on gives you the power to control your finances.

It’s the foundation on which a proactive plan for your money is built.

Disclaimer: This is general information only. In this blog, I share my savings and budget planning and what works for us. You should always consult a qualified financial expert when making money decisions to tailor plans to suit your circumstances.

When to Track Expenses and For How Long

So when should you track your expenses?

If you have moments when you think: “where did all my money go? I was sure that I had a fifty in my purse only yesterday!” that’s a sure sign it’s time to do a little expense tracking.

If:

- You’re creating a budget for the first time

- You have a significant change in your circumstances

- If you’ve become complacent and you want to identify your money leaks and knuckle down on your spending (we all need to do this every now and then)

…then it’s a good time to track expenses for a while.

The point of the exercise is to understand your spending habits, so you don’t need to track your expenses for months or years on end.

(Although, if you love analysing data, then track your expenses for as long as you like).

At a bare minimum, it’s a good idea to track your expenses for a fortnight.

But you’ll get a better idea of your spending if you do it for a month or two.

By then you’ll have a clear picture of your spending habits.

Remember, tracking your expenses isn’t the goal; the goal is to adjust your spending patterns so that they are in line with your long-term financial goals. Tracking your expenses is an initial data collection exercise to help you reach this goal.

How to Track Your Expenses

I first wrote about tracking expenses before smartphones were a thing and before there were hundreds of apps available to easily keep track of your expenses.

Apps make tracking your expenses on the spot super easy and convenient (because who doesn’t go out without their phone these days?). There aren’t any forgotten expenses to compute at the end of the day.

And if you use your bank’s expense tracker or use one that links to your bank, your expense tracking is automated – even easier.

But not necessarily better, and I’ll get to why in a minute.

If you’re interested in using an app for tracking your expenses, check out the article on the money management apps for Australians.

So, why don’t I think apps are the best way to track your expenses?

Because it’s too automated. Too easy. You’re not actively engaging and analysing your spending.

Automation is essential for budgeting, but not for analysing your spending habits.

Use an app to keep track of expenses, but make sure to use a spreadsheet even pencil and paper to get down and dirty with your numbers and get your head around your spending habits.

The Nitty-Gritty Details of How to Track Your Expenses

- Remember to make a note each time you spend money. Use an app on your phone, keep a small notebook at hand, use this printable tracker, or keep the receipt to enter later that day (don’t leave it too long or it will become a big chore that doesn’t get done). Buying coffee? Jot it down. Purchasing something online? Make a note of it. Popping into the supermarket for milk? You know what to do.

- Check your bank for automatic payments like mortgage or rent payments, debt repayments, insurance, fees, charity donations etc.

- Get your family on board too. For your budget plan to be accurate later, you need accurate information now. Let your family know that this is an information-gathering exercise, not a blame game. If this is mission impossible in your household, create a ‘partner’s expenses’ category and guestimate.

Analyse Your Spending Patterns

Once you’ve tracked your expenses for a month or two, you want to analyse the information to be able to see patterns in your spending and use this information to make informed decisions about your spending.

The first step is to organise your expenses into categories. You can do this as you go (and phones apps will allow you to do this) or you can organise your expenses at the end of the month.

I used to work as an accountant, so I’m a fan of using an excel spreadsheet to track my expenses (you can find a bunch of excel tutorials for this here), but pencil and paper work just as well, maybe better.

If you use a money tracking app, it’s a good idea to download the information into a spreadsheet or print it out – analysing data on a little phone screen doesn’t help you ‘see the big picture’.

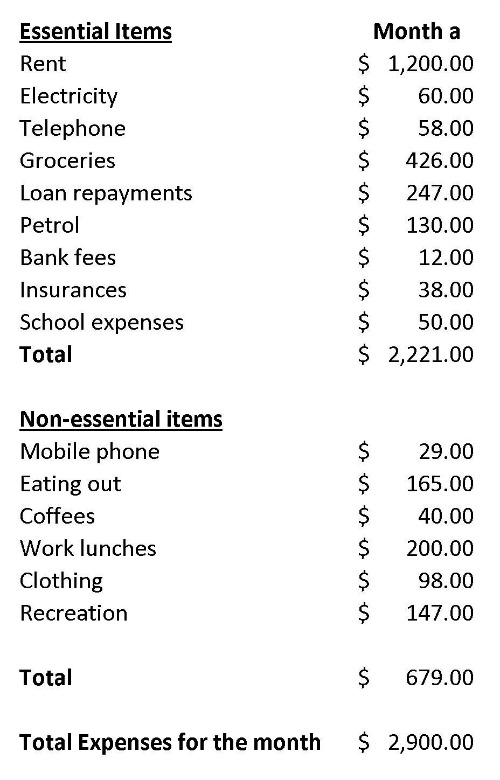

Here’s an example. You may like your categories to be more specific than this one, do what works for you. Remember, this is an exercise to help you gain control of your finances, so sort your expenses into categories that make the most sense for you and your circumstances.

What to do with the information

This is not a budget. So what do you do with this information?

First, are there any surprising amounts that have you thinking: “Gee, I didn’t realise we spent so much on…“? If this is the first time you’ve done this, there might be a few shocks in store. After doing this exercise for decades, I still find shocks when I come back to it.

Small expenses add up, and it’s not until we track exactly by how much that we get a picture of the true impact of our spending patterns.

Here’s an example: maybe you eat work lunches out five days a week. $12 doesn’t seem much at the time, especially if you painlessly ‘Paywave’ it.

But during the month, that adds up to $240 or $2,880 a year.

Tracking your expenses forces you to stop and think about your spending habits – habits you may not have examined in depth.

You can use the information to consider the opportunity cost of your spending habits – what could you be doing with that $2,880 instead of buying lunches?

So, look at your spending habits and be honest about which habits are working for you…and which ones aren’t.

(Further Reading: Get into the Frugal Habit with a No-Spend Month)

Once you’ve done this exercise, you’ll have a pretty good idea of your spending patterns. There’s no need to continue to track your expenses unless you want to.

The next step NOT to create a budget.

Why?

Just say you want to cut your lunch expenditure. So you write up a budget, and in your budget, you write down that you’re going to only spend $50 a month.

And then what happens?

Maybe you stick to this for a while, but then you get busy at work. And you’re hungry. And you fall back onto old habits because you don’t have a working alternative. And at the end of the month, you realise you blew your budget.

So THE NEXT STEP AFTER TRACKING EXPENSES is to choose what SPENDING HABITS you want to change and create a proactive strategy for changing those habits.

This is important: we need to create good habits, not budgets.

So, coming back to our lunch habit, maybe you decide to meal prep for the week on Sundays. Or to make a salad to take to work. And only buy lunch on Fridays.

Once you create those habits, the savings follow automatically.

The final step is to create a proactive money plan that manages your money for you, while you get on with living. One you’ll know you’ll stick to because it’s based on real-world spending data and positive financial habits.

But that’s another article.

Hi Melissa,

I had a laugh when I saw $60/month for electricity. Our last bill for 3 months was $650

My hubby was livid. We have changed plans.

It is so true that to succeeded one has to change habits, replacing the old with new. And ask how you are implementing the change.

thanks

Irene

I know, right! I made that table up a few years ago now and I haven’t had time to update it – goes to show how much electricity has gone up over the years!

Hi Melissa,

brilliant idea to develop habits rather than just writing a budget. I’m going to focus on some habits I’ve lost which were saving me lots of money.

Madeleine

Hi Madeline,

That’s awesome. Good luck :)

Mel