How a Wish List Can Prevent Impulse Spending and Save You Money

This website may earn commissions from purchases made through links in this post.

Looking to curb impulse spending and save money? Here’s how a wish list can help! Free printable wish list, Evernote tips, Notion template and more.

How often do you see something you want, bring it home, and hardly use it? Or worse. You get an attack of buyer’s remorse (while still having to pay off the credit card)?

A wish list can save the day!

Keep track of all your wants and needs, prioritise your spending, save money, and ensure you don’t forget things.

What is a Wish List

Not just for special occasions, a wish list is like a potential shopping list that helps you keep spending under control.

In a nutshell, a wish list is where you keep a record of all the things you want.

Whether you see something at the store that you’re tempted to buy or see something on Instagram that takes your fancy, instead of purchasing the spot, you add it to your list.

This provides a buffer for you to stop and think about the purchase before spending money.

Your wishlist might be as simple as taking photos with your phone or saving items on an Amazon list.

Or you could use a dedicated wishlist app, write your list in your journal or on a piece of paper, create a list in a notebook app like Evernote, or use a Notion database (which I share below).

Writing a list and adding details like cost and where you saw the item helps you make better spending decisions.

The Benefits of Using a Wish List

A wish list is a simple concept that offers a lot of powerful budgeting benefits.

It helps you:

- Avoid impulse buys you might later regret

- Be more mindful of opportunity cost

- Prioritise spending, needs, and wants

- Shows you the total dollar value of your current wants

- It gives you time to budget and save up for a purchase

- Gives you time to comparison shop and look for bargains

You can also use it to share gift ideas if your family asks you for suggestions (it’s best to only share it if they ask first).

How to Use a Wish List to Save Money

While your wish list can be as easy as taking a photo or a screenshot, to make your list really work for you, it’s a good idea to include the following information:

- the date

- purchase amount

- the store you saw the item in

- the priority of what you want to buy

- who the item is for (if the list is for more than you)

Adding the priority to the items on your list, whether it’s a high or low priority, helps you to be mindful of your spending. Tallying up the total cost of everything you want can also be an eye-opener; it’s amazing how much all those impulse purchases can add up!

But you haven’t yet spent that money, so you can give yourself a pat on the back for not spending all that on impulse.

It’s a good idea to periodically review your wish list. It’s common to come across items you thought you really wanted, only for them to be passing fancies you’re no longer interested in. You can cross those items off your list and know you won’t be spending money on frivolous things.

If you DO want an item, you can shop around, compare prices, keep an eye out for sales, or look for it second-hand and get the items you want for the best possible price.

You might also like: How to Track and Save for Multiple Savings Goals.

Create a Gift List for Friends and Family

A wish list can also be a good way to keep track of gift ideas for other people.

Sometimes, I might see something that would make a great gift for a friend’s birthday or a Christmas gift for family, and then months later, do you think I can remember what it was?!

But if I keep a list of these ideas, buying gifts for other people is a lot easier, and you know it’s something they will like because you thought of them when you first saw it.

As a side note, I also keep lists of stuff my family will need soon, but not yet. Things like new shoes or items for school. It’s less of a wish list and more of a future purchases list, but it works exactly the same, and it helps me plan, prioritise, and look out for sales.

Using the Amazon Wish List

If you shop on Amazon, their list function is a great way to save money.

You can use your list to store your wants in one place, help you plan your purchases, watch the prices and wait for sales, collect multiple items to buy at once to save on delivery and share your wish list with family as appropriate.

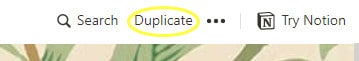

To create a wish list, hover over your ‘account and lists’ option in the top right corner, select ‘create list’, and name it as preferred. You can create multiple lists for different purposes.

Then, when you see something you might want, add it to your list by clicking the ‘add to wish list’ button under the buy button.

The one thing to note when saving items in your Amazon list is to check with other sellers before purchasing if a different seller has a better deal at the time of purchase.

Wish List Apps

Like everything, there’s an app available to help you manage your wish list. Many of the apps are designed to be gift registries, but you can use them

Some apps to consider include:

- Giftbuster (free, iOs and Android, create multiple lists, can be used as a shopping list)

- WishWorks (free, iOs, helps compare prices)

- WishSlate (free iOs, Android, desktop)

- Giftopedia (free, aimed at sharing your wishlist)

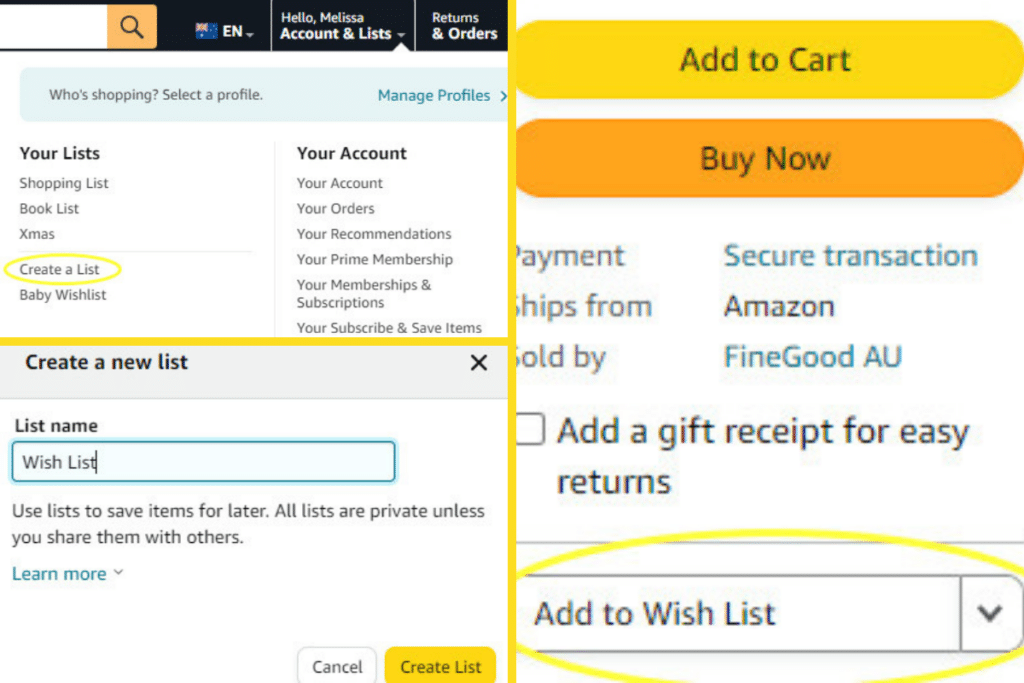

Creating a Wish List in Evernote

Evernote is good for keeping your wish list because of its quick-capture function.

You can use the camera tool to add a picture of something you see in-store directly to the app. You can also use the web clipping tool or share button to save web pages to Evernote.

To organise your wish list, create a folder to store all these easily captured wants.

To take your Evernote wish list to the next level, you can create a note with a table itemising everything in your folder. That way, you can tally the total cost and prioritise items.

The only downside is that Evernote, as yet, doesn’t have an automatic tally – you will have to add up the total yourself.

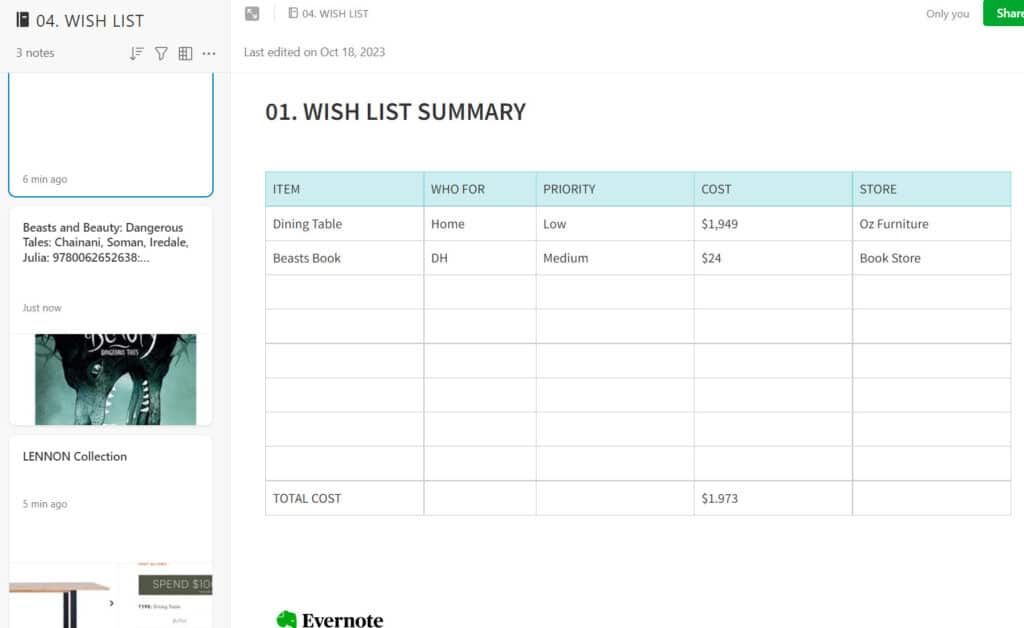

Free Wish List Template in Notion

Prefer to use the Notion notetaking app?

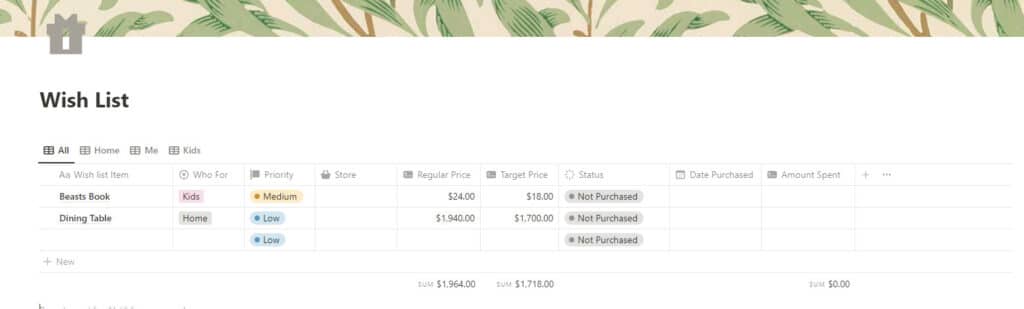

I’ve just started playing around with Notion – like most apps, it has pros and cons. One con is that it has a steep learning curve (at least I found so), but a pro is that, unlike Evernote, your wish list table can automatically add up the total cost, giving you a good idea of the total amount of all your list items.

Notion also has a web clipper to clip web pages and pictures online, but to add photos you’ve taken in-store, you will need to add the images via the app.

I’ve created a wish list database template you can copy and use. You will need a Notion account to use the template.

To get your copy, click the link above and select ‘Duplicate’ in the top right-hand corner to copy the template into your Notion account.

Printable Wish List to Download

Last, if you prefer good old pen and paper, I’ve made a free printable list (PDF) to download and print.

Click the link below to download.

Whether you’re online shopping or shopping in-store, a wish list can help you avoid buying something you don’t need, plan ahead so you can budget your expenses, and help you save by shopping around for the best deal. And they work not just for you but for gift ideas and other shopping needs for the people in your life.