How We Track and Save For Multiple Savings Goals

This website may earn commissions from purchases made through links in this post.

Most of us have many savings goals at once. Here’s the method we use to save for multiple goals simultaneously.

‘I have multiple savings goals over many months. I want to spend on some of them while trying to save enough to cover all of them. How do I calculate?’

It’s normal to juggle multiple savings goals at once, all with different ‘due’ dates.

There are big goals like saving for a house or saving for retirement. There are medium-term goals like saving an emergency fund or saving for a holiday. And then there are shorter-term goals, like saving for the bills.

If you’re a regular reader, you’ll know I’m a big fan of writing down my financial goals and tracking my progress as I work towards them. I also find it easier to save for all our bills each payday rather than trying to find the money when the bills fall due.

Having a Christmas fund, a clothing fund, a school fund, and multiple other savings buckets helps me keep things straight in my mind and ensures I don’t overspend.

Below is the method I use for keeping track of multiple savings goals.

Disclaimer: This is general information only. In this blog, I share my savings and budget planning and what works for us. You should always consult a qualified financial expert when making money decisions (not a random stranger on the internet like me – or even your mate at the pub).

1. We Have a Dedicated Savings Account

We have multiple savings ‘funds’ like a Christmas fund, but I keep all of our ‘savings buckets’ in one bank account and keep track of the different ‘funds’ myself via spreadsheet (you can also use an app or pen and paper – see below).

Some banks allow you to have multiple savings accounts; there’s no right or wrong way to do it, just what works best for you.

We use a savings account that is separate from our everyday transaction account. Every payday, we can transfer savings directly into that account to save towards our multiple goals.

Side Note: Mental Accounting

It’s important to note that this imaginary allocation of funds is called ‘mental accounting‘ by behavioural economists, who argue it’s bad. Economists, specifically Richard Thaler, say that placing different values on money leads to irrational decision-making.

Here’s an example of irrational mental accounting: if we got a work bonus, we might see that money differently than our regular pay and spend it on a luxury splurge we had never intended on buying instead of putting it towards our pre-determined savings goals, even though money is money, no matter how it is earned.

Another example might be to have savings stashed aside for a holiday while carrying credit card debt that we’re paying interest on.

To avoid this mental accounting bias, economists tell us to see money as fungible or interchangeable and not give it labels.

Mental accounting does have some benefits.

It helps us to control spending. For example, it helps us not spend our rent on restaurant dining.

Mental accounting helps us to avoid overspending. When we’ve allocated a set amount for each budgeting category, it helps us to stop spending when we’ve reached our budgeted amount.

It also helps us to allocate and prioritise money between competing wants and needs.

In other words, it helps us juggle money for multiple goals.

If I’ve already allocated money to the car insurance, I won’t blow it on books, dining out or something else.

Savings buckets also help me calculate how much I need to put aside to reach my goals. I don’t have to worry whether or not I will save enough for the upcoming bills in time because I’ve calculated how much I need.

But…

It’s important to remember mental accounting bias when making decisions and to reallocate savings as needed.

For example, it would not be wise of me to put up with an abscessed tooth because I didn’t want to use the money I allocated to car insurance (although if it meant I couldn’t pay the rent, I might make a different decision).

2. We Write Down Our Savings Goals

Keeping track of goals can be motivating when you can watch your progress.

I do this exercise at the beginning of the year, thinking about what short and medium-term goals we want to work towards.

It helps to get all our goals in one place, make a budget, calculate how much we need for each goal, and add the total. It’s easier to plan when we have some targets in place. Although things come up during the year that we hadn’t planned for, and we have to stay flexible, I find a flexible plan is better than no plan at all.

I’m ‘old-fashioned’ and like to use a spreadsheet to keep track of our savings goals (see below).

There are also a bazillion apps if you prefer modern tech, or if you’re neo-old-school, a bullet journal is another option. I have a friend whose creative outlet is creating beautiful journal spreads with goal charts that can be coloured in.

The point is to choose what works best for you.

3. Next, We Prioritise Our Goals

A list of goals isn’t much use until we prioritise the important ones.

We can prioritise goals in two ways.

The first is categorising goals by time into long-term, medium-term, and short-term goals.

A long-term goal might be saving for retirement.

Medium-term goals might be saving for a home.

Short-term savings goals take less than a year or two, like saving for a holiday.

The other way to prioritise goals is by importance or urgency.

This is very personal. What’s important or urgent for one person will be different for another.

But when we don’t have enough money to cover several goals, knowing which ones are important or urgent will help us prioritise which ones to tackle first.

4. We Calculate How Much We Need to Save

Once we’ve written a list of our goals and prioritised them, we add the following information:

- The due date

- The target savings amount

- How much we need to put aside each payday to reach that amount by the due date, i.e. the total amount divided by the number of pays until the due date.

For example, if we want to save $5,000 for a vacation, our due date is one year from now, and we have 12 monthly pays to save, our savings amount each payday would be $417 (rounded).

And we would do this for each goal we’ve written down.

There are many times it would make more sense to save for one goal at a time.

If we were saving for a $500 washing machine and a $5,000 vacation, and we needed the washing machine, it would make sense to save for the washing first, then save for the vacation instead of saving for both at the same time.

Saving for multiple financial goals is more relevant when mixing long and short-term goals, saving for multiple discretionary goals that aren’t urgent, or saving for bills with periodic payments.

What Happens if Our Goals Are More Than We Can Save?

Unless you’re a billionaire, you probably have more savings goals than actual savings. I know we do.

And then there are the unexpected expenses that can derail even the best-laid plans.

When this happens, our options are:

- To prioritise our goals and only save for the most urgent

- Cut back on expenses to boost your savings

- Temporarily pause our savings plan to deal with the unexpected

- Try to earn more money if that is an option

- Lengthen the timeline to give us more time to save

And, of course, we could combine these options if necessary.

Tracking Savings By Spreadsheet

Here’s an example of just two short-term goals: a vacation with 12 months to save (discretionary) and car registration for $800 (non-discretionary) with eight months.

| Goal | Due | Target | Monthly | Sept | Oct | Nov | Total | Remaining |

| Holiday | One year | $5,000 | $417 | $58 | $417 | $209 | $1,101 | $3,899 |

| Car rego | Eight months | $800 | $100 | $100 | $100 | $100 | $400 | $400 |

| Total | $5,800 | $517 | $158 | $517 | $309 | $1,501 | $4,299 |

To reach both goals in time, we would physically deposit $517 into our savings account and write it up as $417 for the holiday and $100 for the mobile phone.

But if there are months we can’t save for both, as in the example above, we would prioritise the most urgent savings (the car registration).

You can use this method to track as many savings goals as you like, but the more goals you have, the longer it takes to save for them.

Sometimes, focusing on a few important ones at a time is better.

I’ve shared how we track expenses in Excel (Google Sheets is similar) if you would like more details on how I build my spreadsheet.

Tracking Savings Using an App

If you prefer to use an app to track your savings goals, many are available – I’ve written about some of the best Australian money apps if you would like to look at some Aussie ones.

But the Goodbudget app is one app that is specifically designed to be a digital version of the old envelope system. It’s free to use (with a premium upgrade, but I found the free version sufficient for my needs), and it doesn’t link to your bank accounts if you’re concerned about data security.

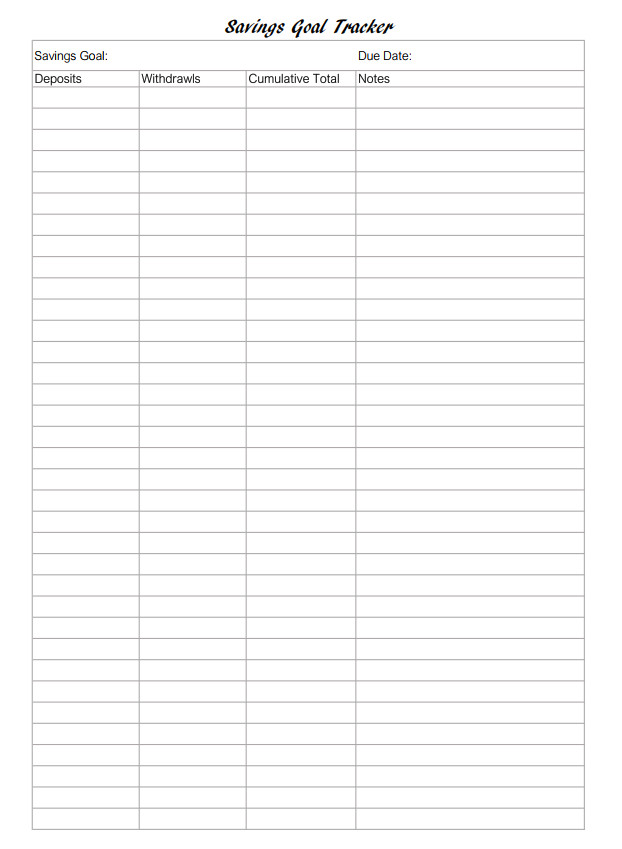

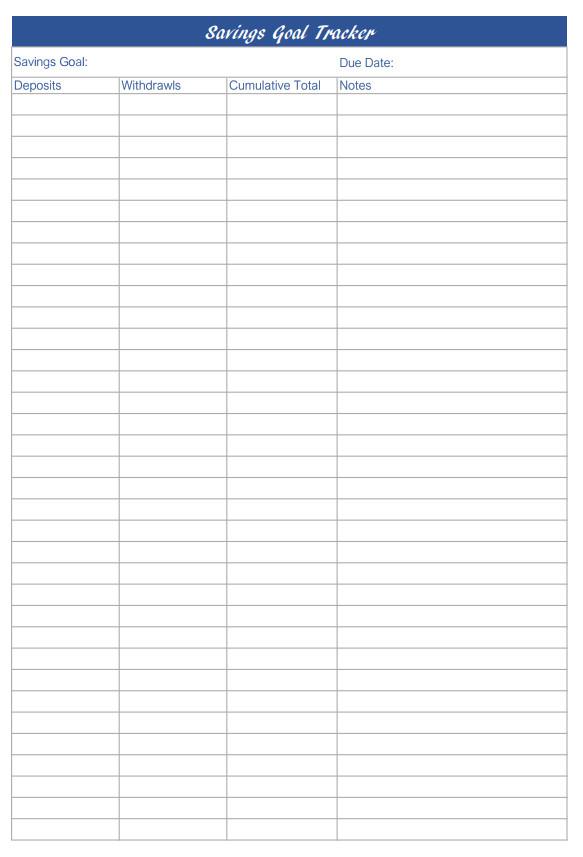

Tracking Savings Goals Using Pen and Paper

Before using Excel, I would track my savings in a little exercise book. If you prefer pen and paper, here’s how I used to do it.

I would have a separate page for each savings goal (or several pages, depending on the size of the goal). At the front of my book, I had a summary page for the total in my savings account.

For each savings goal, I would draw up three columns, as shown below, to keep track of deposits, withdrawals, and the running total.

| Holiday – Target $5,000 | Due: September ‘12 | Monthly Savings: $417 |

| Deposits | Withdrawals | Cumulative total |

| $417 | $417 | |

| $417 | $834 | |

| $209 | $1,043 |

Printable Savings Tracker

If you prefer the pen-and-paper method, below is a printable savings tracker template (PDF) to use as shown above.

You can print it in black and white or use the colour version. Click on the image to download.

There are many ways to save for multiple goals; this is just one way we do it. Ideally, we all have access to a professional advisor who can help us find the best method and products to help us reach our goals. But not all of us do, so the old envelope system can be a good start.

What an awesome post!! :) I save the same way… I choose my goal then split them up! Mostly I like to be prepared for Christmas… so that’s starting today! :)

Hi Carla, thanks. I should also start saving for Christmas too. Ta for the reminder!

There are so many apps which do this now. The one I am using at the moment is so helpful for me as it is so visual. It shows my goals eg. House, Emergency Fund, New Laptop etc. then next to each is a picture of a money box with coins in it, as a percentage of how far I am towards my goal for each. Pressing on any of my goals shows my saving plan (in weeks, fortnights, months or annually, whatever I choose) to reach the goal by my designated date. Also if I put less or more money toward my goal it recalculates my savings plan, same if I take money out from the goal.

The App is called Savings Goals by Corbenic Consulting

btw the pics in the app store are in pounds but it automatically changed to dollars based on my phone settings