How I Create a Savings Plan to Reach Our Savings Goals

This website may earn commissions from purchases made through links in this post.

This is how I create a savings plan to reach my savings goals or when planning large purchases. Includes ways to save extra and tips to stay on track.

We had the plumber out to fix the tap the other day, and he made the comment that our kitchen is ready for a reno.

It’s true.

The kitchen is over thirty years old, the drawers literally no longer close, the tiles are cracked and lifting, and the laminate has peeled from the cupboards. It’s on its last legs.

I replied to the plumber, ‘I know, we’re saving up for it,’ and he gave me the weirdest look because saving up and paying cash is unusual these days.

With inflation, there’s an argument that it’s not always better to save, but that’s a discussion to have with a qualified financial planner who can crunch the numbers for individual circumstances.

If, like me, you happen to be saving up for something, whether it’s a savings goal like a home deposit or a large purchase like a holiday or car, the following is how I create a personal savings plan based on the timeless envelope system.

Disclaimer: This is general information only. In this blog, I share my savings and budget planning and what works for us. You should always consult a qualified financial expert when making money decisions to tailor plans to suit your circumstances.

The 4 Steps to Make A Savings Plan

Whether I’m saving for a vacation, a kitchen or saving for the insurance and car rego, the way I do it is exactly the same.

The key is to reverse engineer each savings goal, which is a fancy way of saying write down how much you need to save in total and the deadline, then work backwards to calculate how much you need to save each payday to reach your goal.

Step 1 – Define My Savings Goals

Before creating a savings plan, I write down what I want to save for and then work out what’s realistic for the budget.

I usually have multiple savings goals, so I write a list of what we want to save for this year. We revisit this list every few months because goals change.

Some things we might save for include:

- upcoming bills

- an emergency fund

- Christmas and birthdays

- clothing

- home repairs

- home goods

- a holiday

- tech replacement

- school expenses

- extra-curricular expenses

In the past, we’ve also used this method to save for a home deposit and car. What we save for has changed over the years as we had kids and they grew older, and our needs and circumstances changed.

It’s easier to start with the most important and pressing savings goals first and build a savings plan as life happens.

While writing a list is easy, saving money isn’t always easy – it once took me a year to save up for a good quality frying pan because I was putting just $2 aside every payday. It would have taken two years, except I purchased it half-price.

Step 2 – Work Out How Much I Need to Save

Once I know my goals, I need to work out how much to save.

This might require some research so I know exactly how much to save.

How much is the electricity bill usually (then I add some for the coming price hikes!)? How much do I need for a planned holiday?

An example of a specific goal might be to save $10,000 for a new (used) car.

Once I know how much we need to save, we also write down the due date for each goal.

These are basically SMART goals. The goal is SPECIFIC (I’m saving for the electricity bill or a holiday, for example), it’s also MEASURABLE (I can see how far I’ve come by looking in the bank) and TIMELY (I know exactly when I’m going to reach my goal.

Is it attainable and realistic? That’s the next question about smart goals.

Step 3 – Work out How Much I Need to Save Each Payday and How Much I Can Save

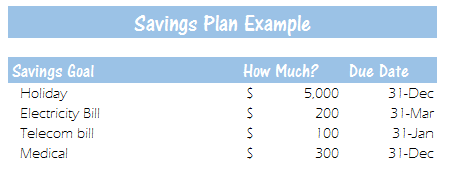

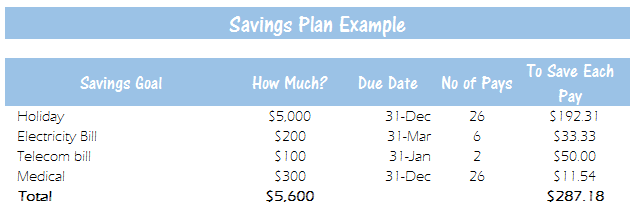

In the example above, the goal is to save a total of $5,600. There are different time frames for each goal, but that’s okay; I’ll show you how I work it out so I can reach each goal in the desired timeframe.

The next step is to calculate how many paydays are between now and the due date for each bill. For example, assuming I get paid fortnightly and my goal is 12 months away, I’ve got 26 pays to save.

I do this for all the savings goals and add up the total.

That’s how much I need to save each payday to reach each savings goal. In the example above, the total amount to save is $287.18 (not including interest).

The next question I ask myself is: is this saving goal ATTAINABLE? Can I actually afford to put $287 away each fortnight on top of rent, groceries etc?

To work that out, I need to fit my savings plan into my broader budget including everyday expenses and debt repayments. You can see how I do that in the article below:

How I Create a Super Simple Budget That’s Easy to Maintain

I also like to track our savings goals using Excel (you can see how I do it here), but this isn’t necessary. I just like to see whether I have enough to cover each bill.

Once I’ve calculated and automated the savings plan, I can be confident my savings are on track (unless, of course, the bills go up a lot).

It helps to update the plan regularly, especially once I reach a goal.

For example, This quarter, I might only have four paydays until the electricity bill is due, so I have to save extra each pay.

But next quarter, I will have the whole six pays to save, which means I can reduce the amount I put aside each pay.

What if I Can’t Afford to Save as Much as I Want?

There are times I can’t save as much as I would like because…life. And a tight budget (see the frying pan story above).

But saving as much as I can makes bill payments a bit easier, even if I haven’t saved the whole amount.

$2 adds up over time (slowly), and when we needed it, it was better than saving nothing.

But if my savings goals are not attainable (which is often the case because the eyes are bigger than the belly, so to speak), I have to:

- prioritise my goals and focus on the most important

- adjust the time frame, so I have longer to save

- find a cheaper alternative (i.e., in the example above, a cheaper holiday)

- or find ways to boost my savings (see below).

Giving My Regular Savings a Boost

If I can save extra money, then I reach my goals sooner.

Ways I can boost my savings include:

- cutting back on expenses

- selling clutter

- picking up extra work

For more ideas, check out these tips for boosting savings.

Avoiding Temptation To Achieve My Goals

The temptation to impulse buy can prevent us from reaching our financial goals within our deadline. So I need to avoid spending money on things I don’t need. I share some of the strategies I use to prevent impulse buying here:

Step 4 – Automate My Savings and Pay Myself First

When I know how much I need to save as part of my savings plan, I use online banking to pay myself first and schedule my savings to go from my transaction account into my online savings account automatically each payday.

That way, I don’t have to worry about saving money; it happens automatically as soon as our pay comes in. Then I can spend the rest on our everyday expenses.

As long as I don’t dip into my savings (and the bills don’t go up too much), I can be assured I will reach my goal while I get on with living.

Paying myself first automatically is one of the best ways I’ve found to stay on track with my savings. Out of sight, out of mind can really help, assuming I’ve properly budgeted my everyday expenses and made an attainable savings goal or adjusted my goals to suit our budget.

Creating a savings plan isn’t bullet-proof because life! But it can help reduce stress when it comes to future expenses and help you reach your financial goals.

And less stress works for me.

I love how organised you are and I am taking some of suggestions onboard, thanks……

LOL, I think I’m really unorganised – that’s why I need to write everything down and automate it.

So do you have bank accounts for each one or just the ones typed in a bold font? I do my budgeting similar except I prefer to transfer it myself instead of having it done automatically. Probably because I’m not as disciplined as you and I like to be able to change the amounts if I want to. But I also enjoy the process of sitting down each fortnight and manually putting the money in, it gives me time to reflect on the increasing dollar signs and pat myself on the back for not being tempted. It also makes me realise when I was tempted how much I COULD have gained if I had stayed the course. My envelopes/accounts are a bit more general like “Car Stuff” “Holiday Stuff” “Household Items” “Everyday Bills” I used to have one titled “Big Bill Lump Sum” Which was a debt I was having certain amounts automatically deducted plus I would put aside a certain amount each fortnight to then apply as a lump sum payment when it added up. I had negotiated with them and they agreed that each time I paid off a certain amount in a lump sum they would drop the interest rate. I am now completely debt free and i bought a car recently, which was separate from the debt. I highly reccomend talking to you bank as it can’t hurt to ask. What’s the worst that could happen…? They so “No”, then you’re not any better off, but you’re not any worse off either.

Reading your blog has helped keep me motivated. So keep up the good work, and thanks for helping me stay focused on my goals, and achieving being “in the black”.

I used to do it automatically, then for the last couple of years did it manually myself for the same reasons. BUT, I’ve gone back to automating it and I find we save lots more because I now ‘can’t’ change the amount if I want, which is what I was doing when I did it manually (well, I can, but I haven’t yet). LOL, like I said above, I think the problem is that I’m not disciplined! This means I don’t need to try to be. But I still get the satisfaction of adding to our excel budget.

I use one account for the lot and break it down in excel. My bank doesn’t offer multiple free accounts ??? I should check that out, maybe they do now.

Congratulations on being debt free! That’s a great idea re the interest rate. I agree, it doesn’t hurt to ask.

I do this but it broader strokes. I put away $200 per week (as I get paid weekly) for my bills – strata, electricity & gas, water, council rates – and any other bills I might struggle to pay from my usual weekly allowance (like the electrician coming). I also put money away to refinance my mortgage at the end of the year (which in the mean time is and would be my emergency fund). Another (free) account saving to do my ’12 in 2′ list – 12 bucket list style things I want to get done in the next 2 years. I then, as a legacy before I had a bills account, save $20 per week for my annual lump sum payment of health insurance. Anything additional can help cover medical expenses that I might struggle with in my weekly allowance. I love knowing I have money set aside for bills, it means I never feel ‘poor’ one week due to bills (I just feel poor for other silly choices, like eating out too much usually!). Thankfully I have no kids, but one day I will, and then I’ll have so much MORE to budget and plan for!